Tax Return for F1 Visa Student

F1 Visa Tax 2011 is made for international students in US with F-1 visa.

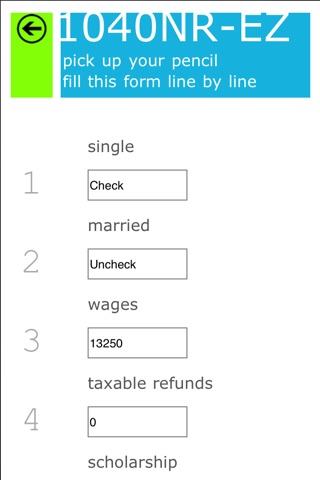

F1 Visa Tax 2011 could help you prepare your form 1040NR-EZ (Income Tax Return fro Certain Nonresident Aliens With No Dependents)

Its FREE!

-----------------------------------------

FEATURES

- EASY: You only need to enter a few numbers from W-2 and 1042-S, we will then figure out everything for you.

- FAST: You can file our 1040NR-EZ right away with only a few clicks.

- ACCURATE: We calculate tax based on IRS tax rates.

- TAILORED FOR F1: We look up tax treaty for you and take treaty exemption and scholarship into consideration.

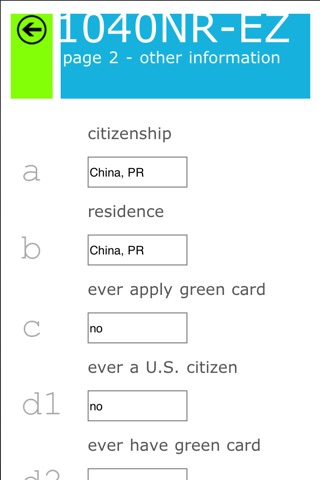

- Current version supports international students from China, Peoples Republic of.

-----------------------------------------

Can I Use F1 Visa Tax?

You can use F1 Visa Tax to prepare form 1040NR-EZ if all following apply.

- You are a F-1 visa holder.

- You have no green card. You are not a US citizen.

- You come to US after 12/31/2005.

- You cannot be claimed as a dependent on another persons US tax return.

- Your taxable income is less than $100,000

- Your income is only from wages, salaries, and scholarship or fellowship grants.